Meet the Class of Care Traders 20–21

At the onset of COVID-19, we collaborated with the Canada Fund for Local Initiatives to launch the largest mapping campaign to recruit smallholder women coffee producers into the Care Trade program. With the support of various local and national partners such as CoopeVictoria, Centro Agricola Cantonal de Frailes and the Coffee Institute of Costa Rica, we were able to successfully recruit 200+ smallholder women coffee producers.

On March 9, 2021, this group graduated and became official ‘Care Traders.’ They were the largest cohort to date to finish our Care Training program, a 12-week training that covers a variety of topics- furthering their knowledge about producing sustainable coffee and leading thriving businesses.

In this piece, we wanted to provide a snapshot of the producers and what we have learned about them from the 2020–21 baseline survey. Below, you will find some key demographic information:

On Location:

In 2020, we worked in 7 coffee-producing regions of Costa Rica, and a majority of the producers were from the Tarrazu and Central Valley Region of Costa Rica.

According to ICAFE, Tarrazu/Los Santos region is the largest producing region of Costa Rica responsible for about 40% of the national production followed by the West Valley (19%) and Central Valley (15%) regions, which also explained the representation of our participants from each of the regions.

Our goal is to reach as many women as possible in the coffee-producing regions in Costa Rica. Due to travel restrictions, we were limited to the online promotion of our program, which also played a key role in the lower recruitment numbers. The lower numbers from Guanacaste and Brunca demonstrated that we need to grow our outreach efforts in the region. We know that our past participants from Brunca have struggled to join online meetings due to a lack of access to digital tools or a general lack of wifi connection. Moving forward, we plan to organize more on-the-road activities to be able to connect with key local-level partners and producer groups.

On Ages:

When we started Bean Voyage, we wanted to make our program accessible to all women producers — regardless of their age. This year’s age range was a proud milestone for our team, as we were able to engage with producers from a variety of ages. As you can see below, we had participants ranging from as young as 18, all the way to 56 years of age.

Intergenerational work is at the core of our mission at Bean Voyage. We want younger generations to be able to see the potential in coffee as a vehicle for economic and social mobility.

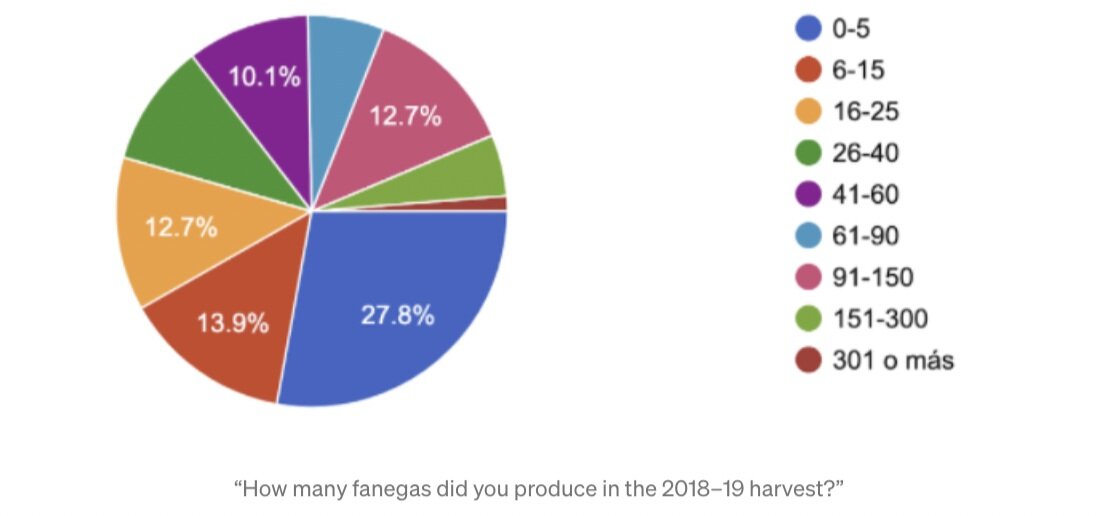

On Production:

We work primarily with smallholder women coffee producers, owning less than 10 hectares of farmland. 64.5% of our partner producers yielding less than 40 fanegas* (approximately 1.8 tonnes in green coffee) of coffee cherries per harvest. According to the baseline data, 22.8% of the producers reported earning no profit from sales of their coffee.

*fanega is a volumetric measure used for coffee cherries. One fanega after milling can weigh on average around 46kg in parchment.

Producers, on average, produce 1–3 varieties of coffee, which provides an important database on the importance of diversification on the farm — within coffee and beyond. In addition, 65.9% of the producers expressed that they sell their produce to local cooperatives or mills, and 7.6% of the producers process their own coffee. That is, not every participant in our program is required to own micro-mills nor need to sell to our platform to participate in the learning program.

On Family:

The average size of the family for our participants is 4.5 including themselves. Understanding the size of the family is important for us as we comprehend the reach and impact of our work and the aspect of thriving livelihood based on coffee production.

Of these family members, the average participant reported that they lived with at least two children or adolescents.

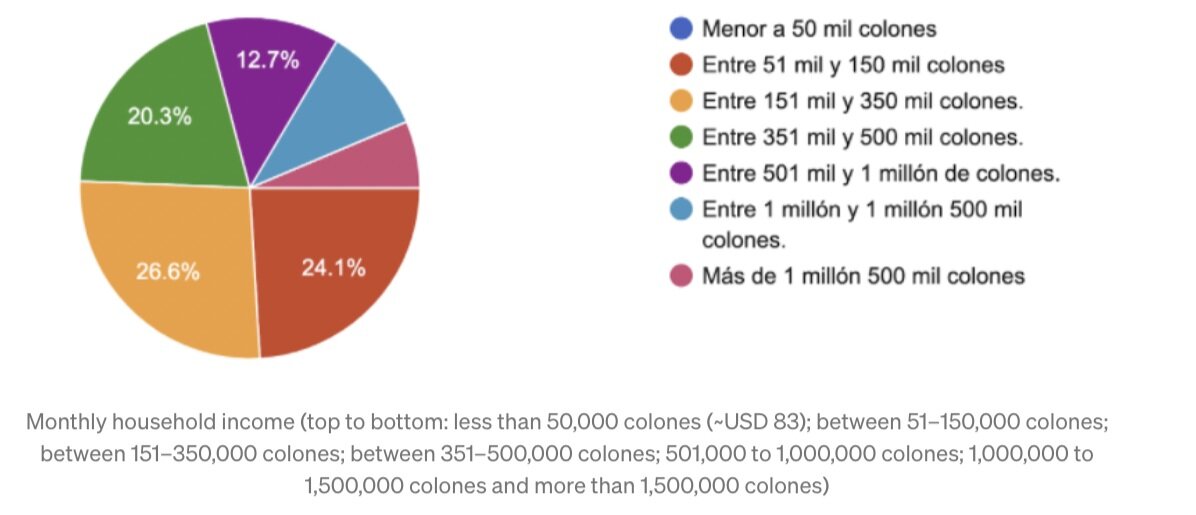

On Financial:

When asking participants about household income and sources of income, we found that 12.7% of our producers were the sole income earners and 78.5% had one or two additional people contributing financially.

Of the income that the producers earned, 30.4% of the income was generated from agricultural activities, whereas 39.2% came from salaries. We discovered that most of the families were earning a monthly income below $811.6 per month, which is roughly $6 per person per day.

Asking the amount of money the families earn every month is an unfair way of calculating actual family income. This number does not take into account high costs of living, which makes such figures a form of false positivity. When we asked producers whether the family income was enough to cover all expenses in the home, 68.4% of the producers responded negatively.

Access to Digital Tools

Although there was only a small percentage of producers who did not own their own cell phones, this number was significant to us as it creates barriers to learning — 4% of the total participants reported not owning their own cell phones. As we led our 2020–21 training program on WhatsApp, making a device important to be able to receive materials, we are also seeking ways to support these producers on their learning journey.

Each element of this baseline survey provides us with much needed information to better support a wider group of smallholder women coffee producers around the country. Based on these data and continued conversations with producers, we have identified the following key commitments:

Focus on growing our range of communities served: in 2021, we plan to further grow our presence in Brunca and Guanacaste, focusing on recruiting more producers through traditional mediums such as the radio and television.

Focus on intergenerational programming: based on having producers from a variety of age groups, we will continue to ensure that our programming is inviting to all ages. This means we will continue to use highly accessible tools such as Whatsapp to provide our virtual programming. We will also adapt to the needs of our older population while incorporating career opportunities within the coffee sector for the younger generation.

Focus on ensuring thriving prices & income: according to the feedback given, the price producers are currently earning is not allowing most to sustain their livelihoods. Looking forward, we will incorporate a thriving income threshold for our producers so that coffee prices do not only cover the cost of production of coffee, but ensure that the producers are able to lead a thriving life. We will also deepen our training module on crop and income diversification so that thriving income can be ensured for producers.

We would like to share our sincere gratitude for all of the producers who took the time to complete our surveys. The information they provided is essential for moving forward in a positive direction and helping us develop as an organization. We would also like to thank the Canada Fund for Local Initiatives, which has provided constant support in this mapping process and shared crucial resources and information for our team to be able to map, research, and provide key tools to smallholder women coffee producers.

Written by Bean Voyage

Edited by Kayla Sippl